Understanding the Need for Real-Time Commission Tracking

In sales, commission is what keeps teams driven. But knowing how much someone has earned, and when they’ll be paid, isn’t always clear. Numbers get updated, deals shift, and people are left wondering what’s going on.

Most teams already track commissions in some way. But when updates are delayed or done manually, it slows everything down. Sales reps don’t know what they’ve earned. Managers don’t have clear insight. And finance spends too much time chasing numbers. It’s not just about the math, it’s about giving everyone confidence in the process.

Imagine a sales rep closes a deal. The amount, product type, and region all affect their commission. But instead of seeing what they’ve earned in Salesforce, they have to wait for someone to update a spreadsheet, verify the details, and send out a summary at the end of the month. Meanwhile, the rep has no visibility.

Now, imagine the rep can open Salesforce and instantly see their commission, calculated automatically from live deal data and company rules. No delays. No manual updates. Just clear, reliable information that keeps everyone informed and focused.

- Common Challenges with Commission Tracking

- Before You Start

- Enabling Real-Time Commission Tracking Salesforce

- Choosing the Right Commission Tracking Approach

- Why Use ScoreKeeper for Commission Tracking in Salesforce?

- Comparing Commission Tracking: Building Complex Logic vs. Using ScoreKeeper

- What a Commission Tracking App Should Have

- Conclusion

Common Challenges with Commission Tracking

If you’ve tried to enable commission splitting Salesforce, you’ve likely run into a few common roadblocks. From data silos to manual updates, these challenges can slow everything down and frustrate your team. Let’s take a closer look at what typically gets in the way and why solving these issues is key to building a scalable, reliable process.

Salesforce Out-of-the-Box Limitations

Salesforce tracks Opportunities, Products, and revenue, but it doesn’t calculate commissions out of the box. Without customization or third-party tools, there’s no native way to show a rep what they’ve earned based on closed deals, different rates, or varying payout rules. This leaves most teams either building their own logic or working around it with exports.

Building Custom Apps

Some companies try to solve this by building their own commission app inside Salesforce. But building a robust, flexible calculator that supports multiple rules, tiers, currencies, and exceptions is harder than it sounds. It takes time, testing, and ongoing maintenance, often pulling admins and developers away from other priorities.

Integration Problems

Other teams turn to third-party commission tools. These may offer automation and flexibility, but getting them to sync cleanly with Salesforce data is often a struggle. Mismatched fields, failed syncs, and API limits can turn into daily headaches. And when the integration breaks, so does the trust in the numbers.

Spreadsheet Challenges

Spreadsheets are often the go-to tool for tracking commissions because they’re easy to set up. But as the team grows, it becomes harder to manage. Formulas break, tabs fall out of sync, and version control turns into a mess. One wrong cell edit can lead to underpaid reps or payout disputes that take days to sort out.

While it’s possible to connect spreadsheets to Salesforce using tools like data loaders or third-party connectors, those setups usually involve manual steps or timed syncs. They don’t support live updates, and the data often lags behind. This means reps close deals in Salesforce but still have to wait to see their earnings elsewhere. Without a real-time link between deal data and commission results, trust in the process suffers.

Insight:

Most spreadsheets have errors, over 90% of them. And about half of the ones used in big companies have serious problems that no one notices. This can lead to reps getting paid the wrong amount and teams losing trust in the numbers.

Before You Start

Enabling commission tracking in Salesforce can transform your sales process, but it’s important to prepare before diving in. Ensuring you have a clear understanding of your current setup will save time and headaches later. Here’s what to focus on before you begin:

- Understand Your Current Commission Process Take a close look at how Salesforce incentive compensation is tracked right now. Are updates manual or automated? Where do delays and errors usually happen? Knowing this helps you identify what needs fixing.

- Gather the Right Data Salesforce commission calculation relies on accurate deal information. Make sure your Salesforce records, like closed deals, products, and payment terms, are complete and trustworthy.

- Clarify Your Commission Rules Document how commissions are calculated in your organization. Are rates different by product, region, or deal size? Clear rules make automation easier and more reliable.

- Identify Stakeholders and Users Who needs access to commission data? Sales reps, managers, and finance teams? Understanding their needs upfront ensures the solution you build works for everyone.

- Set Realistic Goals and Expectations Be clear about what real-time tracking means for your team. It won’t fix all commission headaches overnight, but it should improve visibility, reduce errors, and build trust over time.

- Plan for Testing and Feedback Prepare to test new processes with a small group first. Early feedback helps catch issues and smooths the path for a wider rollout.

- Communicate Early and Often Keep the team informed about upcoming changes and how they’ll benefit. Good communication helps avoid confusion and builds buy-in.

Insight:

Old commission systems are often hard to use.

Sales teams can waste 8-12 hours every month just trying to navigate outdated tools.

This slows down productivity and lowers adoption.

Modern tools are built to be simple and intuitive. That means:

Less time spent on training (up to 30% less),

Faster rollout across teams,

And smarter features like “what-if “ scenarios and forecasts.

Enabling Real-Time Commission Tracking Salesforce

Once you’ve prepared and understand your current setup, it’s time to build a system that delivers commission data instantly and accurately inside Salesforce. Follow these steps to get started:

Step 1: Create a Custom Commission Object in Salesforce

Before anything else, you need a place to store commission records. Start by creating a Commission custom object.

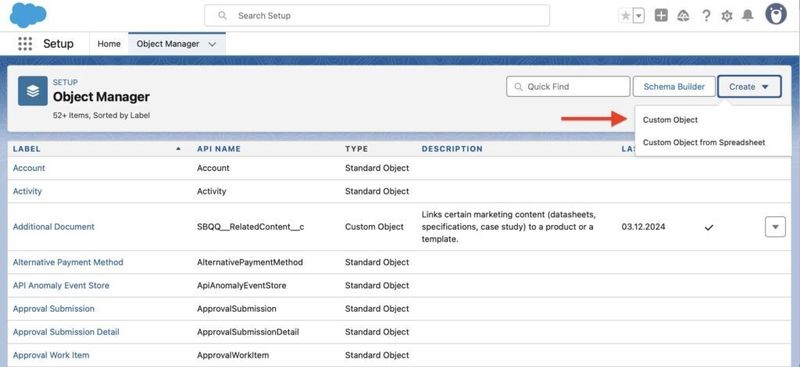

- Go to Setup in Salesforce and click on “Object Manager.”

- Click “Create” – “Custom Object.”

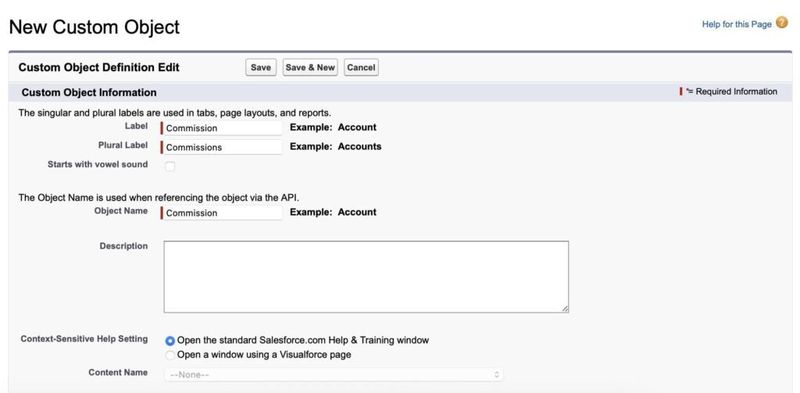

- Fill in the details:

- Label : Commission

- Plural Label : Commissions

- Object Name : Commission

- Select the options : Allow Reports → Track Field History (optional) → Add Notes & Attachments (optional)

- Click Save.

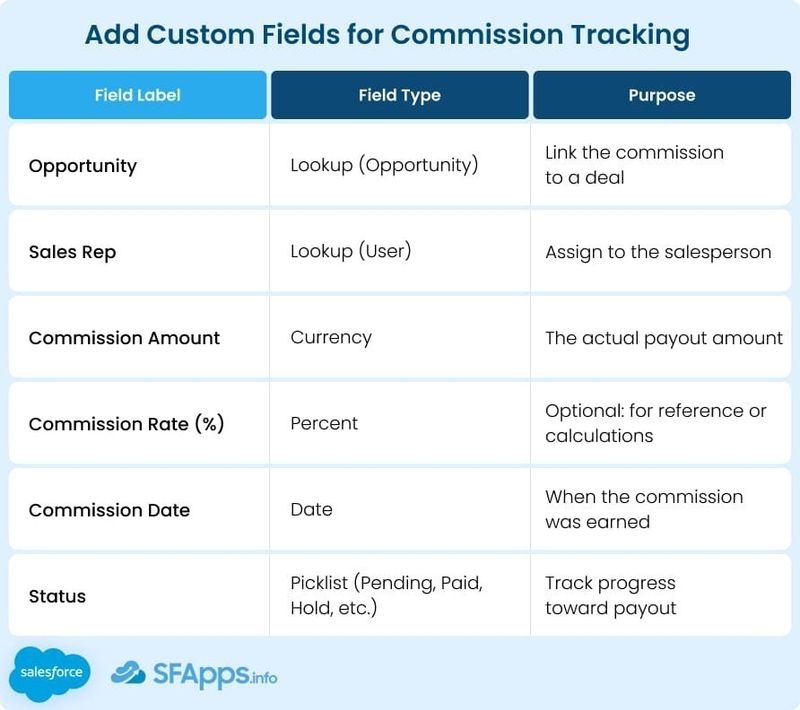

- Now, Add Custom Fields. Still within the new Commission object, click “Fields & Relationships” and add the following:

Step 2: Add a Related List to Opportunity Page Layout

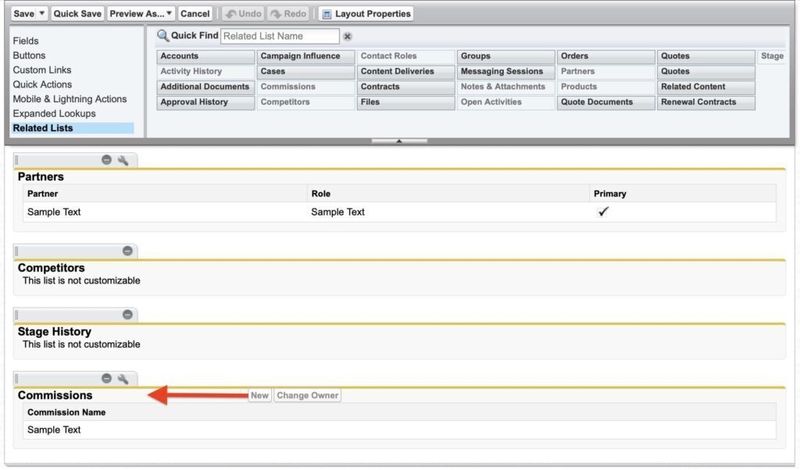

- Go to Object Manager > Opportunity > Page Layouts.

- Edit the layout you’re using.

- Drag the Commission’s related list into the layout.

- Save the layout.

Now you’ll be able to see all related commissions from the Opportunity record.

Step 3: Automate Commission Calculations

Set up Salesforce Flow or formulas that calculate commissions automatically. For instance, create a Flow that triggers when an Opportunity is marked closed as won and calculates commission based on predefined percentages for different product categories. This way, reps don’t have to wait for someone to manually update spreadsheets.

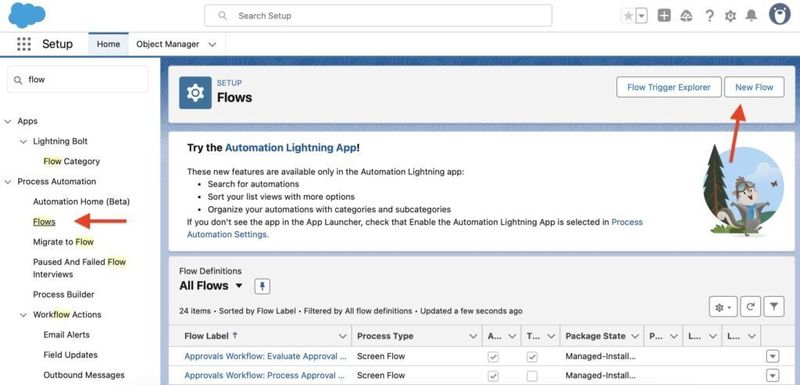

- Go to Setup , type “Flows”.

- Click New Flow , Select Record-Triggered Flow , and Click Create.

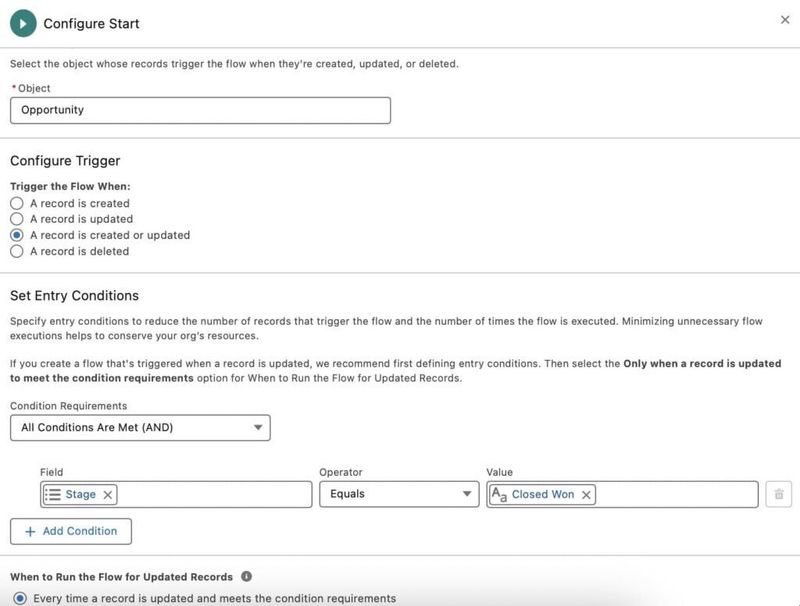

Trigger the Flow When:

- Object : Opportunity

- Trigger : When a record is created or updated

- Condition : StageName Equals Closed Won

- Optimize the Flow for : Actions and Related Records

- Click Done

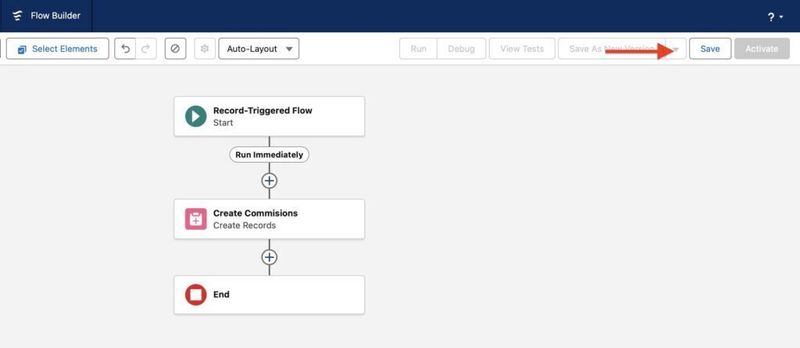

- Add a Create Records Element

- Label : Create Commission Record

- Create 1 new record of Commission__c

-

Field Mapping example:

- Opportunity → Opportunity.Id

- Sales Rep → Opportunity.OwnerId

- Commission Percentage → Hardcoded (e.g., 10) or based on custom logic

- Commission Amount → Opportunity.Amount * 0.10 (use formula)

- Status → Draft

- Payout Date → TODAY() or add 30 days (TODAY() + 30)

- Save the Flow

- Tracking Commissions with Apex in Salesforce. If your commission logic is complex or requires more control than Flow provides, Apex is a great alternative. You can write Apex triggers or classes to calculate and store commissions when Opportunities are closed.

Here’s a basic example: Track commissions when an Opportunity is marked “Closed Won.”

The commission is 10% of the Opportunity Amount and is saved in a Commission__c.

trigger CalculateCommission on Opportunity (after update) {

List commissionsToInsert = new List();

for (Opportunity opp : Trigger.new) {

Opportunity oldOpp = Trigger.oldMap.get(opp.Id);

// Only calculate if Opportunity was just marked Closed Won

if (opp.StageName == 'Closed Won' && oldOpp.StageName != 'Closed Won') {

Decimal commissionRate = 0.10; // 10%

Commission_c commission = new Commission_c();

commission.Opportunity__c = opp.Id;

commission.Commission_Amount__c = opp.Amount * commissionRate;

commission.Sales_Rep__c = opp.OwnerId;

commissionsToInsert.add(commission);

}

}

if (!commissionsToInsert.isEmpty()) {

insert commissionsToInsert;

}

}

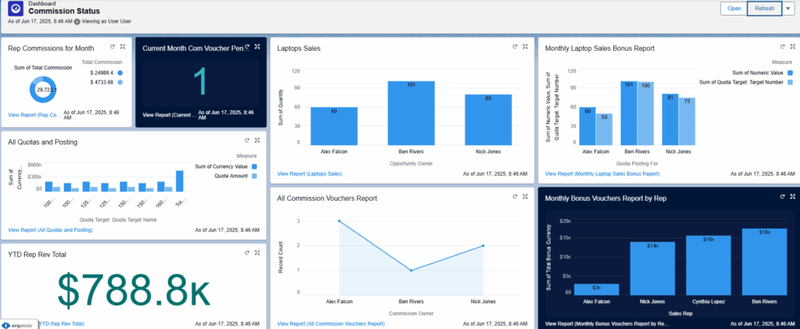

Step 3: Create Clear Commission Fields and Reports

Add custom fields on the Opportunity or a related Commission object to show calculated commission amounts. Build reports and dashboards that update in real time, letting sales reps and managers see earnings by deal, by month, or by region. For example, a dashboard can show total commissions earned this quarter alongside sales targets.

Step 4: Give Sales Reps Easy Access

Use Lightning components or custom record pages to display commission info directly on Opportunity records or on a dedicated “My Commissions” page. This means reps can check their current earnings anytime without digging through spreadsheets or emails.

Step 5: Integrate with Specialized Commission Software if Needed

If your commission plans involve multiple tiers or bonuses, you might need to integrate Salesforce with other commission management tools that you use. These tools sync with Salesforce and handle complex calculations, disputes, and payout tracking.

Step 6: Test Thoroughly with a Pilot Group

Before rolling out, test your flows, reports, and pages with a small team. For example, select a group of reps and managers to use the new system for a month, then collect feedback on accuracy and ease of use.

Step 7: Provide Training and Support

Create quick guides or host live sessions showing how to view commission details and understand reports. For example, a short video demo on accessing the commission dashboard can boost adoption.

Choosing the Right Commission Tracking Approach

Not every company’s needs are the same. Here’s how to decide what approach fits your team best, whether you want to keep everything inside Salesforce, build something custom, or use third-party tools:

1. Tracking Inside Salesforce with Custom Features

Building commission logic with Flows, formulas, and dashboards gives you full control, but it can quickly become complex. Handling exceptions like split deals or refunds requires ongoing updates and testing. Without dedicated admin support, it’s easy for things to break or go out of sync.

Best for: Teams with Salesforce admin resources and custom rules.

Tip: Use Flow to calculate commissions from Opportunity data and show results on dashboards or user records.

2. Custom Apps (External or Internal Builds)

Some companies build their own commission tracking apps, either as standalone tools outside of Salesforce or as custom apps within their org. External apps allow for complete flexibility and custom interfaces, while internal Salesforce apps keep everything in one system.

Best for: Large teams with engineering support or unique processes that can’t be handled by standard tools.

Watch out: External builds require reliable data syncing, or reps may lose trust in the numbers. Internal apps may still take time to develop and maintain, especially without dedicated Salesforce expertise.

3. Third-Party Tools

There are many external platforms that offer powerful commission tracking, but they live outside of Salesforce. While they can offer deep features, they often require additional work to connect and keep aligned with your CRM data.

Best for: Finance-heavy workflows with complex payout logic.

Challenge: Reps may need to jump between tools, which reduces transparency.

4. Native App from the Salesforce AppExchange (Recommended)

If you want a solution that works inside Salesforce, uses your existing data, and requires little setup time, this is the best place to start. These apps are built to integrate directly with your CRM, often include ready-made dashboards and automation, and don’t require custom development.

Best for: Teams that want real-time commission tracking without building from scratch.

Example: ScoreKeeper is a native Salesforce app that supports real-time updates and handles complex commission rules without the need for heavy customization.

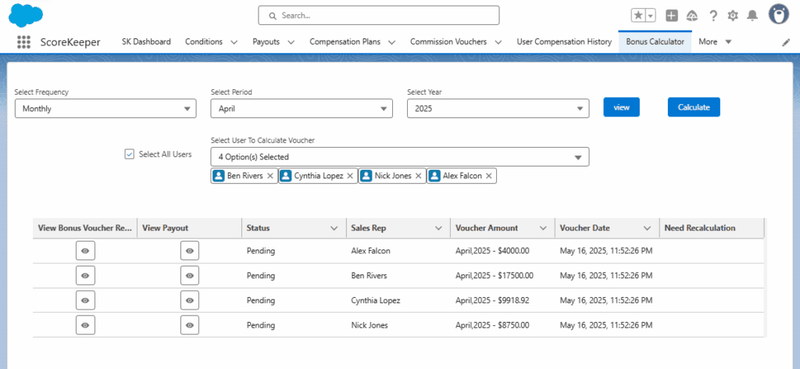

Why Use ScoreKeeper for Commission Tracking in Salesforce?

ScoreKeeperis a purpose-built app designed to handle commission tracking directly within Salesforce, without the need for complex formulas, custom code, or spreadsheet workarounds.

Instead of spending weeks building flows or writing Apex to calculate commissions, ScoreKeeper provides pre-built logic, customizable plans, and real-time dashboards right out of the box. It’s built natively on Salesforce, so it respects your existing data, user permissions, and reporting tools.

Key Features of ScoreKeeper

- Prebuilt Commission Features : Easily define rules by product, role, territory, or quota, no coding required.

- Real-Time Dashboards : Sales reps and managers see up-to-date earnings instantly.

- Audit-Ready Tracking : Every calculation is transparent, with full change history and reporting.

- Multi-Tier & Bonus Logic : Easily manage team splits, accelerators, and multi-tier commissions, including payouts to managers.

- Native Salesforce App : No external integrations needed, it runs entirely in your org.

- Quick Setup : Start tracking commissions in hours, not weeks.

ScoreKeeper is ideal for revenue teams that want visibility, finance teams that want accuracy, and admins that want simplicity. It removes the guesswork from commission tracking and helps your team stay focused on performance, not spreadsheets.

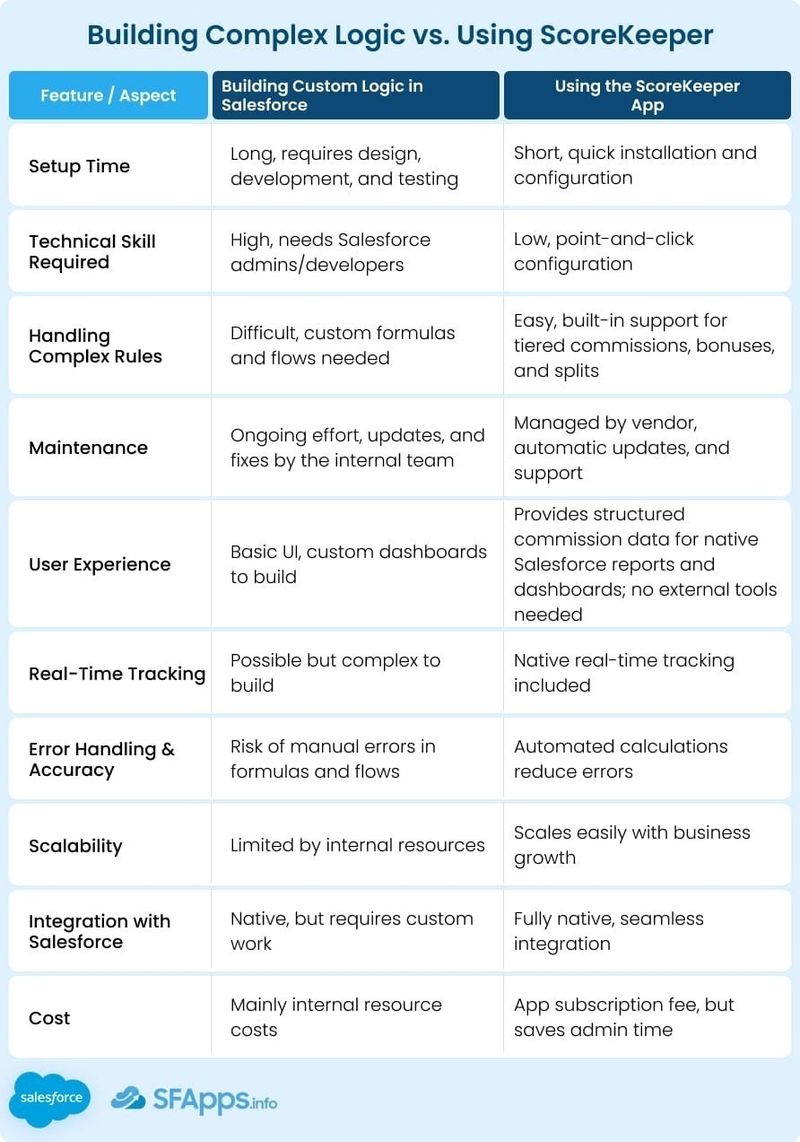

Comparing Commission Tracking: Building Complex Logic vs. Using ScoreKeeper

Let’s take ScoreKeeper as an example to compare the experience of building complex commission logic yourself in Salesforce versus using a purpose-built app:

While it’s possible to build a commission tracking system using native Salesforce tools, it often requires significant time, technical effort, and ongoing maintenance. ScoreKeeper offers a faster, more reliable solution that’s easy to use, scales with your team, and helps ensure accuracy, without the admin overhead.

What a Commission Tracking App Should Have

If you’ve tried building commission logic in Salesforce and found it too complex, or if external tools felt disconnected or hard to use, a Salesforce commission software could be the best option. These apps work directly inside Salesforce and are designed to be easier for both admins and sales teams.

Here’s what a great commission tracking app should include:

- Works Natively in Salesforce The app should live inside Salesforce, not as a separate platform. This keeps everything streamlined and avoids the need for multiple tools or data syncing.

- Real-Time Updates Commissions should update automatically when opportunities are closed or payment statuses change, so reps always see the most current numbers.

- Flexible Rules Your commission logic should be easy to configure, whether it’s based on region, product type, deal size, or custom tiers, without needing custom code.

- Easy for Reps to See Their Earnings Reps should be able to see their commission breakdowns directly on their dashboards or record pages, so there’s no need to chase finance for answers.

- Finance-Friendly Controls Features like approval workflows, locked periods, and payout calendars are essential to help finance teams manage commissions reliably and securely.

- Clear Salesforce commission reporting The app should offer out-of-the-box dashboards or report builders, so teams can track payouts, team performance, and trends over time.

By the way, ScoreKeeper is a native Salesforce app designed to make commission tracking easy, automated, and fully transparent. It combines the power of automation with the flexibility teams need, without the pain of disconnected spreadsheets or rigid third-party systems.

Conclusion

Real-time commission tracking, Salesforce isn’t just a technical upgrade, it’s a strategic shift. When sales reps know exactly what they’ve earned, managers can forecast with confidence, and finance can reduce reconciliation headaches, the entire business moves faster and smarter.

By understanding your current setup, addressing key challenges, and choosing the right tools, whether built-in Salesforce features, custom apps, or third-party integrations, you can design a commission system that’s accurate, scalable, and trusted by everyone involved.

Start simple, test often, and always keep transparency front and center. The more your team can rely on the numbers, the more they can focus on what matters: closing deals and growing the business.

If you’re looking for a powerful, native solution that covers everything from automation to visibility, ScoreKeeper is a great place to start. It’s built for Salesforce, easy to set up, and designed to scale as your team grows.

The post How to Enable Real-time Salesforce Commission Tracking first appeared on Salesforce Apps.

Top comments (0)