Choosing the right Certinia consulting services provider can make or break your project’s success. Whether you’re planning a fresh ERP or PSA implementation, seeking customization, or aiming to optimize operations, finding a partner with deep domain expertise, proven methodology, and transparent costs is critical.

According to aggregated data from verified vendor transactions, the median annual spend on Certinia subscription-based services is approximately $65,000, with a typical range between $4,300 and $210,000 depending on scale, modules, and contract complexity. That underscores the significant investment involved – and why selecting the right consulting provider matters.

Implementation fees themselves can vary widely. For FinancialForce PSA (Professional Services Automation), small businesses often spend $5,000–$10,000, while complex enterprise deployments may exceed $50,000. Similarly, FinancialForce ERP implementations typically range from $20,000–$50,000 for small-to-medium businesses, while large enterprises may incur costs upwards of $100,000.

- Why Choose a Certinia Consulting Services Provider?

- Key Factors to Consider When Choosing a Certinia Consulting Services Provider

- Pricing Models for Certinia (FinancialForce) Consulting Services

- Cost of Certinia (FinancialForce) Consulting Services

- Common Mistakes to Avoid When Choosing a Certinia (FinancialForce) Consulting Partner

- FAQs

- Conclusion

Why Choose a Certinia Consulting Services Provider?

When investing in Certinia consulting services, organizations often underestimate the complexity of ERP, PSA, or FinancialForce accounting consulting projects. These implementations touch every core business process – finance, projects, resources, billing, and analytics. Many companies also choose to hire Certinia (FinancialForce) PSA admin to manage day-to-day PSA operations and ensure the system runs smoothly. Without expert guidance, businesses risk delays, cost overruns, and systems that don’t align with their workflows.

Struggling to find the right Certinia (FinancialForce) consulting partner?

Get expert help with ERP, PSA, and Accounting implementations!

What These Providers Offer

- Implementation Expertise – Certified FinancialForce ERP implementation consultants ensure smooth system rollouts, mapping existing processes into the Certinia framework and minimizing disruption.

- Customization & Configuration – Every business is unique. Providers tailor workflows, dashboards, and reporting to your operational needs.

- Integration Services – Most companies don’t run Certinia in isolation. Consultants connect it with Salesforce, external CRMs, HR systems, and third-party apps to enable a unified d ata environment.

- Ongoing Support – Beyond go-live, providers deliver FinancialForce consulting remote or offsite, ensuring continuous optimization, training, and troubleshooting.

Benefits of Partnering

- Faster Time-to-Value – Reduce implementation cycles from months to weeks.

- Specialized Expertise – Work with FinancialForce PSA consultants who’ve solved challenges for similar industries.

- Lower Risk – Avoid common pitfalls like misaligned accounting setups or flawed project billing structures.

- Scalability – Remote teams provide consulting services offshore, making support available around the clock.

- Cost Efficiency – Strategic outsourcing allows firms to tap global expertise without inflating headcount.

Insight:

The global ERP software market was valued at $50.57 billion in 2021 and is projected to reach $123.41 billion by 2030, reflecting a compound annual growth rate (CAGR) of 10.7%.

Key Factors to Consider When Choosing a Certinia Consulting Services Provider

Selecting the right Certinia consulting services partner is not just about technical expertise – it’s about finding a team that aligns with your business goals, industry needs, and long-term strategy. The wrong choice can lead to wasted investment, but the right one can accelerate growth and efficiency. Here are the key factors to evaluate:

1. Expertise and Certifications

Look for proven experience with FinancialForce consulting providers that can demonstrate Salesforce and Certinia certifications. A certified FinancialForce ERP implementation expert or FinancialForce PSA consultant ensures that your project is guided by best practices and avoids costly misconfigurations.

2. Industry Experience

Different industries use Certinia in unique ways. For example, a professional services firm may prioritize PSA modules, while a manufacturing company may focus on ERP and accounting. Choosing a provider with sector-specific experience ensures faster implementation and more relevant solutions.

3. Service Delivery Model

Providers offer different delivery models:

- Onsite teams for close collaboration.

- Remote or offsite for flexibility.

- Offshore for cost efficiency and round-the-clock support.

The best choice often depends on your budget, timeline, and need for hands-on interaction.

4. Range of Services

A strong partner goes beyond implementation. They should provide:

- Customization for unique workflows

- Integration with Salesforce and third-party systems

- Ongoing support and training

- Accounting consulting to optimize finance operations

5. Communication and Collaboration

Transparency in communication is essential. Providers should offer clear roadmaps, regular progress updates, and accessible points of contact. This builds trust and ensures your team feels supported throughout the engagement.

6. Cost and Flexibility

Cheaper is not always better. Instead of focusing only on the lowest price, evaluate whether the provider offers flexible pricing models – such as project-based, hourly, or on-demand – to fit your unique requirements.

7. References and Case Studies

Always ask for client references or case studies. Seeing how a provider handled similar challenges in the past offers valuable reassurance and sets realistic expectations.

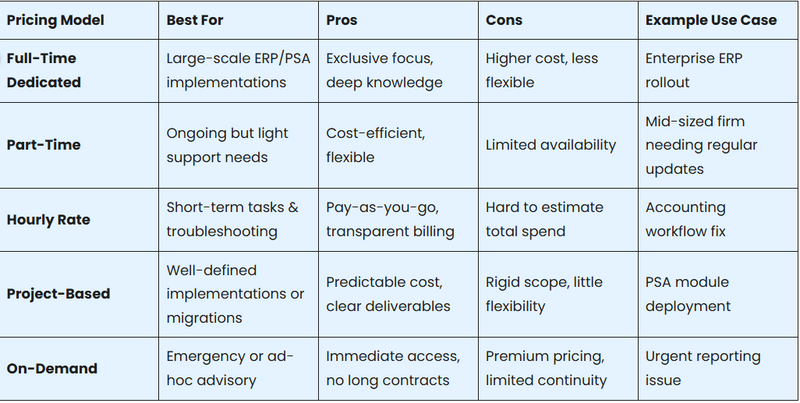

Pricing Models for Certinia (FinancialForce) Consulting Services

When evaluating providers, one of the most important considerations is the pricing structure. Different providers offer different engagement models, and the right choice depends on your project scope, budget, and timeline. Below are the five most common pricing models for Certinia consulting services:

1. Full-Time Dedicated Model

With this model, you hire Financialforce ERP developer or PSA consultant dedicated exclusively to your project. It’s ideal for complex ERP or PSA rollouts that require deep focus, continuity, and tight integration with your internal teams.

2. Part-Time Model

In the part-time model, consultants divide their time across multiple clients. This is a good fit for companies that don’t need a full-time presence but want regular support and expertise.

3. Hourly Rate Model

This model charges based on actual hours worked. It’s a straightforward approach often used for troubleshooting, FinancialForce accounting consulting, or small-scale enhancements.

4. Project-Based Model

In this approach, the scope, timeline, and cost are fixed upfront. It’s popular for defined projects like a new FinancialForce consulting services offsite implementation or migrating an accounting system.

5. On-Demand Model

On-demand services provide Сertinia consulting services remote or offshore whenever you need quick help. It’s useful for emergencies, system audits, or short-term advisory work.

Insight:

Approximately 55% to 75% of all ERP projects fail to meet their objectives, with the top reasons being inadequate quality of testing and insufficient business process re-engineering.

Cost of Certinia (FinancialForce) Consulting Services

When considering Certinia services, understanding the potential cost is essential. Prices can vary widely depending on project complexity, the provider’s delivery model (onsite, offsite, remote, or offshore), and whether you’re implementing ERP, PSA, or specialized FinancialForce accounting consulting. It’s important to find a Salesforce consultant with experience in Certinia to ensure your implementation is smooth and aligned with business needs.

Key Cost Drivers

- Scope of Implementation A basic deployment of FinancialForce ERP for a small business might only involve a few modules, while a global enterprise rollout could include multiple integrations, custom workflows, and data migrations. The broader the scope, the higher the cost.

- Service Delivery Model

- Onsite typically costs more due to travel and dedicated resource expenses.

- Remote or offsite options reduce overhead while still offering consistent expertise.

- Offshore provides the most cost savings, often at 30-40% lower rates compared to local consultants, while still delivering certified expertise.

- Consultant Expertise Engaging a seasoned FinancialForce ERP implementation consultant or FinancialForce PSA consultant may cost more per hour, but the efficiency and accuracy they bring often reduce overall project costs.

- Customization and Integration Needs Standard “out-of-the-box” implementations are cheaper. Costs increase with advanced customizations (e.g., tailored accounting rules, PSA billing logic) or integrations with third-party apps.

- Ongoing Support Long-term support packages, such as part-time retainers or on-demand troubleshooting, add recurring costs but ensure your system evolves with your business.

Typical Cost Ranges

- Small businesses : $5,000–$15,000 for limited PSA or ERP setups

- Mid-market organizations : $20,000–$50,000 for broader deployments, including integrations and training

- Enterprises : $75,000–$150,000+ for complex, multi-country ERP and PSA implementations

Hourly rates for certified FinancialForce consulting services providers generally range from $80–$150/hour offshore and $150–$300/hour onsite.

Hidden or Overlooked Costs

- Training & Adoption – Employees often need multiple sessions before confidently using the platform.

- Data Migration – Moving legacy data into Certinia can be time-consuming and expensive.

- Change Requests – Scope creep or “just one more feature” requests quickly add up.

- Post-Go-Live Support – Remote or on-demand help is often billed separately from the main implementation contract.

Want to speed up your FinancialForce implementation?

Our certified consultants help you go live faster – with fewer risks and no setbacks.

Common Mistakes to Avoid When Choosing a Certinia (FinancialForce) Consulting Partner

Investing in Certinia services is a major decision. Yet many businesses rush the process and end up with misaligned providers. To make the most of your investment, here are the mistakes you should avoid:

1. Choosing Only by Price

Many companies are tempted by the cheapest bid, especially when comparing financialforce consulting services remote options. While offshore can provide excellent value, choosing solely on cost often leads to delays, rework, or poor adoption. Always weigh cost against expertise and proven results.

2. Overlooking Certifications and Experience

Not every provider employs certified FinancialForce ERP implementation consultants or FinancialForce PSA consultants. Skipping the credential check can leave you with a team that lacks the skills to configure modules correctly or integrate them with Salesforce and third-party systems.

3. Ignoring Delivery Models

Every business has different needs. Some require close collaboration through onsite support, while others thrive with remote or offsite teams. Failing to evaluate the right delivery model can result in mismatched expectations and communication challenges.

4. Skipping Reference Checks

A glossy website or sales pitch doesn’t guarantee performance. Many buyers forget to request case studies or talk to previous clients. Real-world success stories are the best predictor of whether a provider can deliver results for you.

5. Underestimating Long-Term Support Needs

Implementation is only the first step. Some businesses forget to budget for training, system optimization, and ongoing support. A good certinia services provider should outline clear post-go-live options, whether that’s part-time retainers, on-demand troubleshooting, or offshore support coverage.

FAQs

1. What do FinancialForce consulting services providers do?

They handle ERP, PSA, and accounting consulting, plus implementation, customization, integration, and support. Their goal: make Certinia (FinancialForce) work smoothly for your business.

2. How much do Certinia consulting services cost?

Small projects start at $5K–$10K. Mid-size deployments run $20K–$50K. Complex ERP rollouts can reach $100K+. Offshore providers often save 30–40% compared to local rates.

3. Can I work with consultants remotely or offshore?

Yes. Many offer remote, offsite, or offshore services, giving flexibility and lower costs. Just make sure communication and project management are strong.

4. What’s the difference between an ERP consultant and a PSA consultant?

- ERP consultant – finance, accounting, inventory, operations.

- PSA consultant – projects, billing, time tracking. Both are often needed, but they solve different challenges.

5. What’s the biggest mistake when hiring a provider?

Picking only by price. Cheap financialforce consulting services offshore can look attractive, but without proven expertise, projects risk delays and poor adoption.

Conclusion

Choosing the right Certinia (FinancialForce) consulting services provider is critical to the success of ERP, PSA, or accounting implementations. Careful evaluation of expertise, industry experience, delivery models, and pricing ensures that your investment translates into efficient workflows, accurate reporting, and smooth adoption. By avoiding common mistakes and planning for both implementation and ongoing support, organizations can maximize the value of Certinia and achieve long-term operational success.

The post How to Choose Certinia (FinancialForce) Consulting Services Provider first appeared on Salesforce Apps.

Top comments (1)

Great insights here, Dorian! You've laid out clear criteria — certification, domain expertise, pricing transparency — for selecting a Certinia / FinancialForce consulting partner. I especially appreciated how you cautioned against choosing by cost alone and emphasized long-term support. Thanks for sharing this valuable guide — it will definitely help organizations make more informed decisions!