Introduction

Generative AI is no longer a futuristic concept. It is transforming the financial technology (FinTech) sector by enhancing efficiency, accuracy, and decision-making processes. With its ability to generate complex data patterns and simulate human-like reasoning, Generative AI in FinTech is rapidly being adopted by financial institutions globally. By 2024, this technology will become integral to the growth and competitiveness of the financial landscape, providing innovative solutions that reshape customer experiences, streamline operations, and drive economic value.

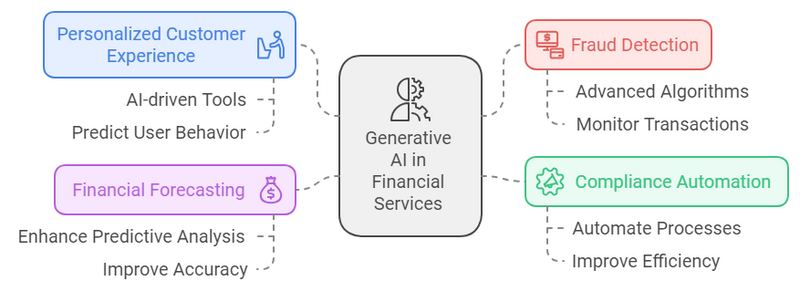

Key Benefits and Opportunities for Financial Services

The adoption of Generative AI in FinTech brings numerous benefits:

- Personalized Customer Experience: AI-driven tools can predict user behavior and deliver tailored services.

- Fraud Detection: Advanced algorithms monitor transactions in real-time, reducing the risk of fraud.

- Compliance Automation: Regulatory processes can be automated, making compliance more efficient.

- Financial Forecasting: AI enhances predictive analysis, improving the accuracy of financial decision-making.

Top Use Cases of Generative AI in FinTech

Enhancing Customer Experience through Personalization

Personalization is at the forefront of modern FinTech strategies, and Generative AI is leading this transformation. From AI chatbots to virtual assistants, financial institutions are leveraging AI to provide a more personalized experience. These systems analyze customer data in real time, offering tailored financial products and advice.

- Chatbots and Virtual Assistants: Generative AI powers conversational agents that interact with users, resolving issues, and offering insights.

- Customer Insights: AI can sift through vast datasets to generate accurate, personalized financial advice, driving engagement and satisfaction.

Advanced Fraud Detection and Risk Management

Fraud detection is a critical concern in the financial industry. Generative AI is revolutionizing risk management by improving the accuracy and speed of fraud detection.

- Real-Time Transaction Monitoring: AI-driven systems can detect unusual patterns in financial transactions and flag potential fraud instantly.

- Risk Management Models: Generative AI helps financial institutions create advanced risk models that adapt to emerging threats.

Automating Compliance and Regulatory Processes

Staying compliant with ever-changing regulations is a massive task for financial firms. Generative AI simplifies this by automating reporting and compliance checks.

- Regulatory Reporting: AI systems can quickly generate reports required for compliance, reducing the burden on human resources.

- Automated Audits: Compliance audits can be streamlined through AI, ensuring accuracy and efficiency.

Improving Financial Forecasting and Data Analytics

Accurate forecasting is crucial in finance. Generative AI enables financial analysts to create predictive models that help in making data-driven decisions.

- Predictive Analytics: AI algorithms analyze market data and economic trends to forecast potential financial outcomes.

- Investment Strategies: Generative AI helps firms develop dynamic strategies that adapt to market fluctuations.

Top 10 FinTech Startups Leveraging Generative AI in 2024

1. Startup 1: AI-powered Financial Insights for SMEs

This startup offers AI-driven insights tailored to small and medium-sized enterprises (SMEs), helping them make informed financial decisions.

2. Startup 2: Revolutionizing Digital Payments with Generative AI

Focused on digital payments, this startup uses Generative AI to enhance transaction speed, security, and customer satisfaction.

3. Startup 3: AI-driven Wealth Management Platforms

With AI-powered platforms, this startup offers personalized wealth management solutions, making financial planning more accessible to users.

4. Startup 4: Generative AI for Real-Time Fraud Detection

This innovative firm has developed real-time fraud detection systems, ensuring financial transactions are secure and reliable.

5. Startup 5: Automating Loan Approvals with AI Algorithms

Using AI, this startup automates the loan approval process, making it faster and more accurate for both lenders and borrowers.

6. Startup 6: Personalized Insurance Solutions Using Generative AI

By harnessing AI, this company creates customized insurance plans based on individual risk profiles and financial history.

7. Startup 7: AI-based Cybersecurity Solutions for Financial Services

This startup provides cutting-edge AI cybersecurity tools, protecting financial institutions from evolving digital threats.

8. Startup 8: Generative AI to Enhance Financial Literacy Tools

Focusing on education, this startup uses AI to create interactive financial literacy tools that engage users and improve their understanding of personal finance.

9. Startup 9: AI-powered Investment Management Tools

This firm provides AI-powered tools that help investors manage portfolios with real-time insights and predictive analytics.

10. Startup 10: Innovative AI-driven Credit Scoring Models

Revolutionizing credit scoring, this startup uses AI to assess creditworthiness more accurately, opening new opportunities for financial inclusion.

Shaping the Future: Generative AI in Financial Services

The Shift from Traditional to AI-Powered Financial Models

Generative AI is steering the financial industry away from traditional models by introducing smarter, AI-powered systems. Financial institutions are increasingly adopting AI-driven solutions to improve efficiency, reduce costs, and enhance decision-making processes.

AI’s Role in Decentralized Finance (DeFi) and Blockchain

Generative AI is poised to play a significant role in the growth of decentralized finance (DeFi) and blockchain technologies. It can help enhance the security of blockchain transactions while automating complex smart contracts.

The Impact of AI on Financial Inclusion Globally

AI is driving financial inclusion by enabling underserved populations to access banking services. With AI-powered credit scoring models, more individuals can secure loans, regardless of their geographical location or financial history.

AI and the Future of Payments and Digital Banking

The future of digital banking lies in AI. From seamless payments to personalized banking experiences, AI is redefining how consumers interact with their finances.

Accelerating Digital Transformation with Generative AI

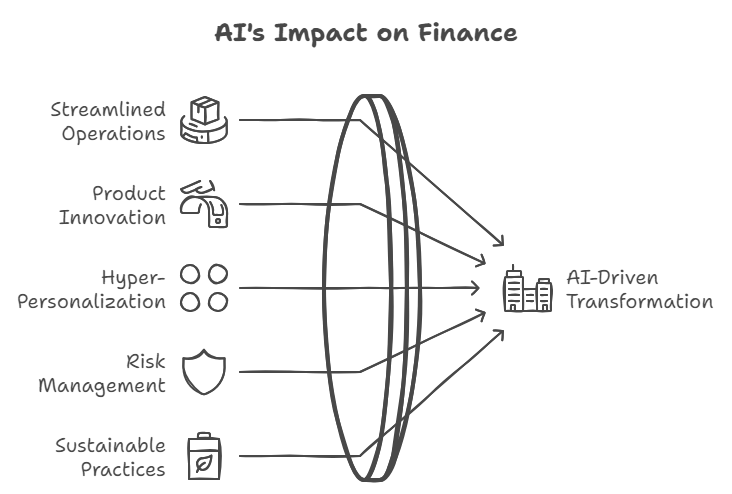

Streamlining Operations and Reducing Costs with AI

Generative AI is streamlining financial operations by automating routine tasks, such as customer service inquiries and transaction monitoring. This not only reduces costs but also improves service efficiency.

AI-Driven Innovation in FinTech Product Development

The development of FinTech products has accelerated thanks to AI. Financial institutions are now able to create more innovative, user-friendly products that cater to the evolving needs of consumers.

Generative AI for Hyper-Personalized Financial Services

AI’s ability to analyze vast amounts of data enables hyper-personalization in financial services. Whether it’s personalized credit offers or tailored investment strategies, AI ensures that each customer receives services that fit their unique needs.

AI-Enhanced Risk Management and Regulatory Compliance

Risk management is being transformed by AI’s ability to predict and mitigate potential risks before they escalate. Furthermore, compliance processes are becoming more efficient as AI ensures that financial institutions adhere to regulatory requirements.

The Future of AI in Shaping Sustainable Financial Practices

Generative AI is also contributing to sustainability in the financial sector. By optimizing resource use and reducing waste, AI is helping financial firms adopt more sustainable business practices.

Conclusion:

Generative AI in FinTech is revolutionizing the industry by offering innovative solutions that improve customer experiences, streamline operations, and enhance financial security. As we move beyond 2024, AI will continue to play a critical role in shaping the future of finance. Financial institutions that embrace generative AI will be well-positioned to lead in this rapidly evolving landscape.

FAQs

What is Generative AI, and how does it differ from other AI types in FinTech?

Generative AI focuses on creating new data or predictions, unlike other AI types that analyze or process existing information. It is particularly useful in generating financial forecasts and personalized customer experiences.

Which FinTech sectors are most impacted by Generative AI in 2024?

Sectors such as digital payments, wealth management, cybersecurity, and compliance are seeing the most impact from Generative AI.

What are the challenges in adopting Generative AI in financial services?

Key challenges include data privacy concerns, high implementation costs, and the need for specialized AI talent.

How can startups effectively integrate Generative AI into their financial solutions?

Startups can leverage AI by focusing on automating processes, improving customer engagement, and enhancing fraud detection systems.

What are the ethical concerns surrounding Generative AI in FinTech?

Ethical concerns include data privacy, potential biases in AI algorithms, and the impact on employment due to increased automation.

Top comments (40)

Based in London, Enticeable offers dynamic marketing and consultancy services designed to help businesses thrive in one of the world’s most competitive markets. From tailored digital campaigns to expert business strategies, we provide innovative solutions that drive growth and visibility london. Whether you’re a local startup or an established brand, our London-based team is dedicated to helping you reach your business goals with creativity and expertise. Elevate your success with Enticeable in London.

Generative AI is revolutionizing the FinTech industry by enabling smarter decision-making, personalized customer experiences, and enhanced fraud detection. In 2024, its transformative impact is expected to accelerate innovation in financial services, from automating processes to creating tailored financial products. This technology is reshaping how institutions interact with customers and manage operations, paving the way for a more efficient and data-driven financial landscape. Just as Generative AI transforms FinTech by creating tailored experiences, vinyl wraps for events serve as a creative tool to personalize branding and enhance customer engagement. Both technologies focus on customization—Generative AI in digital solutions and vinyl wraps in physical spaces

iFleetServices provides reliable utility trailer repair near you, offering expert solutions for all trailer issues utility trailer repair near me. Whether it’s tire repairs, brake maintenance, suspension problems, or electrical malfunctions, their skilled technicians handle it all. With mobile service options, iFleetServices comes to your location, ensuring quick and efficient repairs with minimal downtime. Available 24/7, trust iFleetServices for professional, on-site utility trailer repair services that keep your trailer in top working condition.

Efficient IFTA record-keeping is essential for trucking companies to stay compliant with tax regulations IFTA Record keeping. Accurate tracking of fuel purchases, mileage, and trip details ensures seamless reporting and avoids penalties. Modern solutions streamline the process by automating data entry and generating detailed reports. By adopting advanced tools, businesses can save time, reduce errors, and focus on their operations. Stay organized and compliant with reliable IFTA record-keeping systems tailored to your needs.

Découvrez PremiumOTTIPTV, la solution ultime pour accéder à vos chaînes préférées en HD. Profitez d'une large sélection de contenus : films, séries, sports, et divertissements, adaptés à toute la famille les mots clés. Avec un service fiable, une installation rapide, et un support client réactif, transformez votre manière de regarder la télévision. Passez à l'IPTV premium dès aujourd'hui et vivez l'excellence du streaming en illimité, où que vous soyez.

The financial sector continues to be shaped by emerging technologies, offering new opportunities for savvy investors. One particular stock that's gaining attention is being closely analyzed by platforms like FintechZoom.com. Investors are keeping an eye on its performance, with reports providing insights into market trends and potential growth. Regular updates on this stock help traders stay informed, making it easier to assess its impact on the broader fintech landscape.

Understanding market trends and evaluating company performance are key steps in making smart investment decisions. Reliable platforms that offer in-depth insights can help investors stay ahead in the ever-changing financial landscape. The Fintechzoom com provides detailed stock analysis, breaking down complex data into actionable information. Whether you're a seasoned trader or a beginner, it’s a go-to resource for staying informed and making well-rounded decisions in the stock market.

BonusQR’s cashback loyalty program allows businesses to reward customers with cashback on every purchase Cashback Loyalty program. Customers simply scan a QR code to earn a percentage of their spending back, which they can use on future purchases. This digital solution makes it easy to track rewards without physical cards, boosting customer satisfaction and encouraging repeat visits. With insights into spending habits, businesses can tailor promotions, enhancing engagement and building lasting loyalty through valuable cashback rewards.

La sensation de jambes lourdes est souvent causée par une mauvaise circulation sanguine, entraînant fatigue et inconfort dans les membres inférieurs jambes lourdes. MultiPharma propose une gamme de produits adaptés, tels que des gels rafraîchissants, des compléments alimentaires et des bas de contention pour soulager les jambes et stimuler la circulation. En suivant les conseils de MultiPharma, vous pouvez retrouver une sensation de légèreté et améliorer votre confort au quotidien.

Das CNC-Biegen von Metall mit ProLaser ermöglicht präzise und maßgenaue Formgebung von Metallteilen für vielfältige Anwendungen CNC-Biegen von Metall. Mit computergesteuerter Technik biegt ProLaser Materialien wie Stahl, Aluminium und Edelstahl in die gewünschten Formen und Winkel, ohne die Materialqualität zu beeinträchtigen. Die CNC-Biegetechnologie garantiert Wiederholgenauigkeit und Effizienz, ideal für komplexe und individuelle Projekte. ProLaser steht für Qualität und Fachkompetenz im Metallbiegen und liefert exakte und robuste Ergebnisse für anspruchsvolle Anwendungen.

Some comments may only be visible to logged-in visitors. Sign in to view all comments.